The global heating, ventilation, air conditioning and refrigeration (HVAC&R) industry has been left justifiably concerned by the prospect of Donald Trump being re-elected U.S. president. Trump administration policies promise transformation in environmental regulation, energy policy and global trade dynamics that will have major implications for market supply, demand and innovation globally.

Changing Environmental Regulations and Energy Policies

The Trump administration will relax environmental regulations, which may lower costs for U.S. HVAC manufacturers but also slow the pace of innovation in energy efficiency and carbon emission reduction around the world. The process of transitioning away from refrigerants, critical to global work, could also be loose on oversight. A U.S. exit from the Paris Agreement would also undermine global climate action and heighten concern for environmental sustainability efforts.

On energy policy, Trump’s pro-fossil fuel agenda could help decelerate the electrification revolution, do away with heat pump tax credits and reinstate markets for oil and gas boilers, threatening further growth in renewables generation and efficient HVAC technologies.

How It Could Reshape Global Trade and “Made in the U.S.”

India is telling international manufacturers to shift operations away from the U.S. market, as high tariffs on imported goods like HVAC equipment will encourage domestic manufacture within India. This change would have major consequences for Chinese, Mexican and Japanese manufacturers that now manufacture the majority of products sold in the United States.

While American factories may expand at the expense of global companies, the transformation of industrial supply chains will take time and investment. This has led to challenges such as a shortage of skilled labor and technical expertise within the HVAC industry, though manufacturers from the U.S., Japan, and South Korea are increasing investments in domestic plants to overcome these hurdles.

Implications for Chinese Manufacturers

A declining domestic market and overcapacity have forced Chinese HVAC companies to depend heavily on exports. And the proposed 60 percent tariff on Chinese goods could make exporting air conditioners to the United States economically infeasible. Many Chinese companies have long relocated operations to Southeast Asia to avoid tariffs, but potential trade barriers there could worsen cost pressures going forward.

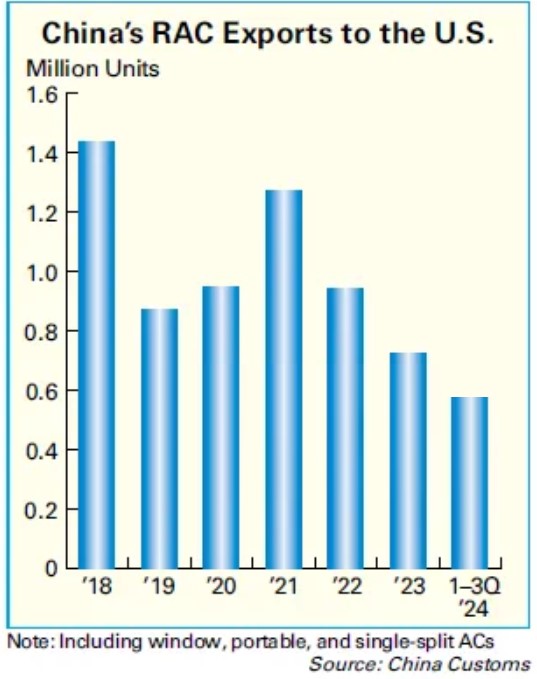

Though exports to other areas of the world are on the rise, China’s share of the U.S. HVAC market has consistently dropped since 2018 when then-President Donald Trump first started a trade war with China. If the U.S. continues to close its market behind protectionist measures, significant uncertainty — and possible realignment — should be expected in the global HVAC&R supply chain.

With Trump at the helm once again, expect industrial supply chains to be big business — and a re-shuffling of global trade / manufacturing strategies. As the world moves on from these challenges, we’ll need to consider new megatrends likely shaped by this context and how they’ll affect the HVAC&R industry that serves as one of modern infrastructure’s foundations. Although these changes continue to pose challenges, they could also lead to localized innovation and new market strategies around the world.

Post time: Dec-05-2024