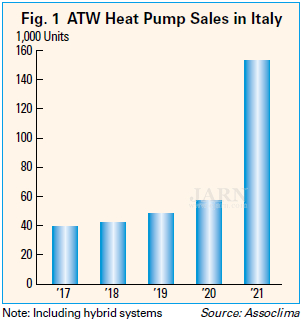

The air-to-water (ATW) heat pump market in Italy and Europe as a whole registered historic growth in 2021. Several factors generated huge sales volume increases in all segments.

Italian Market

The Italian ATW heat pump market achieved impressive sales of more than 150,000 units in 2021, up from 57,000 units in 2020 and about 40,000 units in 2017.

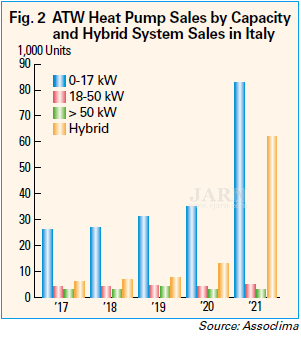

Of the total of 150,000 units, hybrid systems, a challenging new segment, represented about 62,000 units. Sales of hybrid systems significantly increased, due to a very positive match with special incentive plans launched by the Italian government to enhance energy efficiency in buildings, normally based on the following three components, very often supplied as a unique system, defined as:

Of the total of 150,000 units, hybrid systems, a challenging new segment, represented about 62,000 units. Sales of hybrid systems significantly increased, due to a very positive match with special incentive plans launched by the Italian government to enhance energy efficiency in buildings, normally based on the following three components, very often supplied as a unique system, defined as:

Component 1: Gas-fired condensing heat generator derived normally from condensing boiler solutions;

Component 2: Electrically driven reversible ATW heat pump that can supply space heating and space cooling and can produce domestic hot water (DHW);

Component 3: Central control system, normally fully integrated, able to completely control all the components electrically and electronically, promoting the use of the best performing/most efficient technology, e.g. using a gas-fired condensing heat generator when outdoor air temperatures are extremely low, and using a heat pump generator mainly when outdoor temperatures allow efficient use of the electric energy necessary to run the heat pump.

Italy is one of the largest heating markets in Europe. In recent years, Italy has been promoting renewable energy heating, partly due to the European Energy Performance of Buildings Directive (EPBD) of 2018/844/EU amending Directive 2010/31/EU on the energy performance of buildings and Directive 2012/27/EU on energy efficiency and the Directive 2018/2001/EU on the promotion of the use of energy from renewable sources. In particular, ATW heat pumps, including both monobloc and split types, with or without integrated hot water tanks, have been expanding. In addition, hybrid systems have been rapidly developing, thanks to their benefits i.e. smart technology and the combination of ATW heat pump technology and traditional combustion technologies. In the hybrid system segment, as usual, Italian manufacturers are demonstrating their ability to rapidly adapt to market changes, becoming immediately leaders in the production and sales of these products.

Note: The Italian ATW market data in this section are based on an Assoclima survey on the Italian heating, ventilation, and air conditioning (HVAC) market that was presented in Milan, Italy, on March 25, 2022.

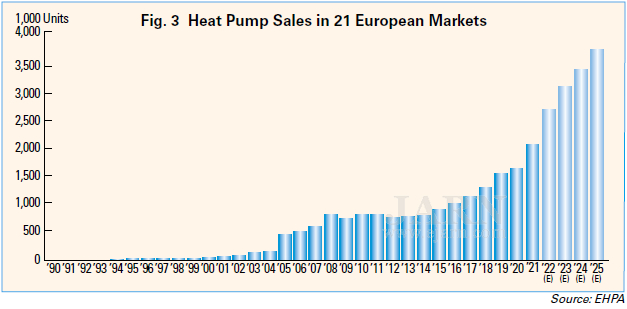

European Market

Prospects for 2022

In Europe as a whole, the heat pump market has been showing a very positive trend recently. According to comments by Thomas Nowak, secretary general of the European Heat Pump Association (EHPA), there are concrete possibilities that the heat pump market in the European Union (EU) has the potential to grow by 20 to 25% year on year in 2022. That will be an additional 500,000 units of heat pumps, such as air-to-air (ATA), ATW, and geothermal types, deployed for space heating and water heating.

Market Challenges

The EU heat pump market currently faces some challenges such as shortages of semiconductors and other components, as well as future potential shortages of skilled professionals.

Most of these challenges can be solved by the European Chips Act which embodies measures to ensure the EU’s security of supply, resilience, and technological leadership in semiconductor technologies and applications, and also #Skills4climate that aims to train skilled professionals for the green and digital transition.

However, the cost issue remains. For example, the prices of copper, aluminum, steel, and other metals have been increasing tremendously. To keep the prices of heat pumps affordable, all relevant approaches are needed. Energy prices are also increasing. Some governments impose higher taxes on electricity than fossil energy and still subsidize fossil energy.

In addition, it is not yet easy to order a heat pump. Users need to talk to many experts and obtain financing.

Hence, the challenge is much bigger than just adding manufacturing capacity. A long-term approach is needed to build up the European and the global heat pump market with the ultimate goal of full decarbonization of heating and cooling in buildings.

Energy Efficient Standards

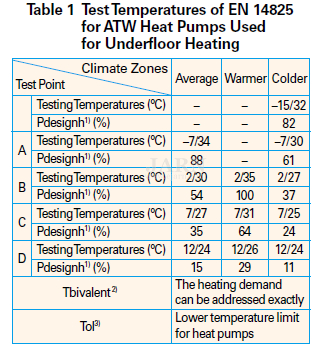

Heat pumps need to reach certain levels of performance to receive incentives in each European country. From this point of view as well, the energy-saving performance of heat pumps has become an important point for manufacturers.

As for the performance ratings of heat pumps, more European standards are adopting seasonal energy efficiency ratio (SEER) and seasonal coefficient of performance (SCOP), shifting from energy efficiency ratio (EER) and coefficient of performance (COP). The former standards include ‘EN 14825: Air conditioners, liquid chilling packages and heat pumps, with electrically driven compressors, for space heating and cooling – Testing and rating at part load conditions and calculation of seasonal performance’, while the later standards include ‘EN 14511: Air conditioners, liquid chilling packages and heat pumps with electrically driven compressors for space heating and cooling and process chillers, with electrically driven compressors – Part 1: Terms and definitions’.

As for the calculation of SCOP, with EN 14825, the heat pump must be tested at a series of temperatures corresponding to the temperatures defined in EN 14511. An example of the test temperatures for ATW heat pumps in different climate zones is given in the Table 1. Concerning the test points for European energy labeling and minimum requirements, for all heat pumps, SCOP for the Average climate profile is mandatory, while it is voluntary for Warmer and Colder areas.

Intelligent controllers and drivers now play important roles in improving the seasonal performances of ATW heat pumps, by managing their maximum energy efficiency during year-round operations.

There are two main trends in heat pump controllers and drivers: the modular approach and the on-demand approach. In the case of the modular approach, controllers and drivers are created as product packages that best meet the needs of the customers. For on-demand approaches, controlers and drivers are specifically designed and tailored according to customer needs, starting from standardized elements.

Notes

1) Pdesignh: Declared cooling/heating load

2) Tbivalent: Bivalent temperature that means the outdoor temperature (°C) declared by the manufacturer for heating at which the declared capacity equals the part load and below which the declared capacity must be supplemented with electric back-up heater capacity in order to address the part load for heating.

3) Tol: Operation limit temperature that means the outdoor temperature (°C) declared by the manufacturer for heating, below which the air conditioner will not be able to deliver any heating capacity. Below this temperature, the declared capacity is equal to zero.

Source: Danish Energy Agency

For more information, please visit: https://www.ejarn.com/detail.php?id=70744&l_id=

Post time: Aug-23-2022